1) Working harder or increase your value as a worker

Everyone knows this principle. You need to work harder, maybe to have a second or third job. On the other hand, you can specialize as a professional, taking courses or having certifications. You can also start a business.

2) Spending less

This principle is also well known. You need to cut your spending using those famous spreadsheets.

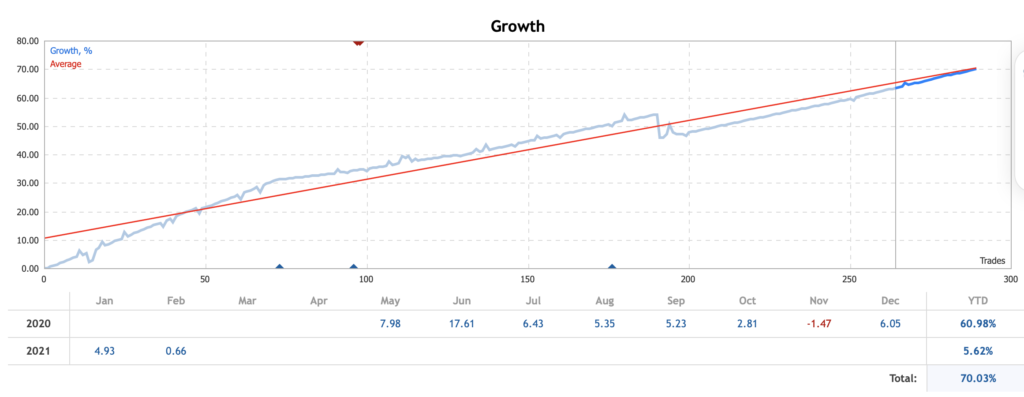

3) Increasing the rate of return on your investments

Here is where the magic happens. Most people do not know this principle, which is the most important of all. The first two principles have resulted in a linear model, and the third one has resulted in an exponential model. For this reason, you need to focus on how to invest better.

The power of compound interest

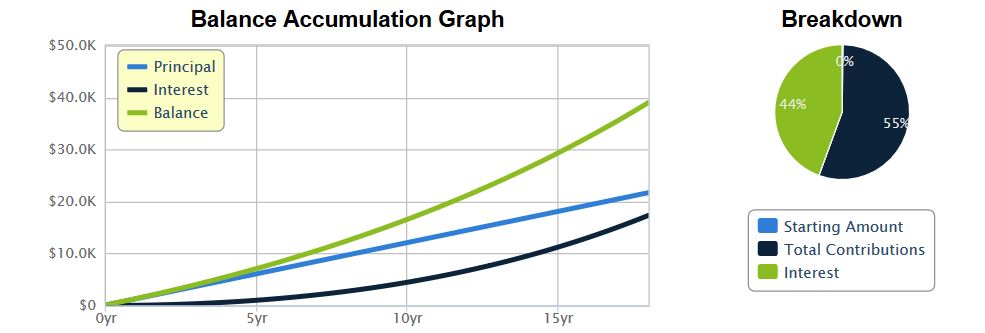

Consider you have $100 monthly to invest, and you decide to invest for 18 years. Then you find three types of investment:

a. 0,5% monthly

In this situation, you will have deposited $21.700,00 and received $17.337,64 as interest. In the end, you will have $39.037,64.

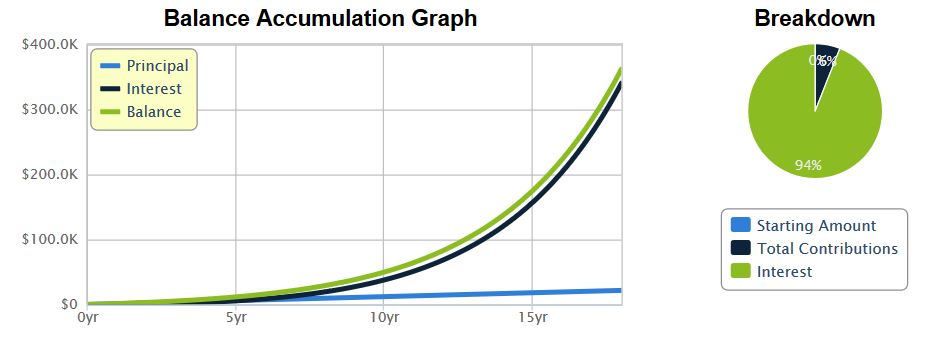

b. 2% monthly

Here you will have deposited $21.700,00 and received $340.589,46 as interest. In the end, you will have $362.289,46. In this situation, you will receive $7.100,78 monthly after 18 years if you do not want to spend all the capital.

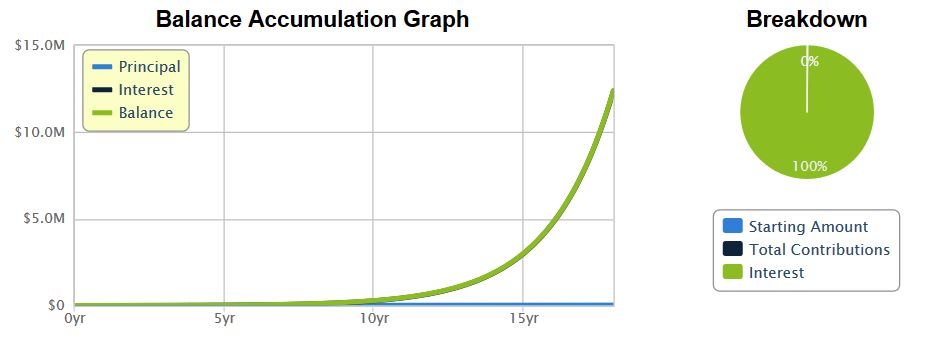

c. 4% monthly

In this hypothetical scenario, you will have deposited $21.700,00 and received $12.393.338,83 as interest. In the end, you will have $12.415.038,83.

Pay attention that your deposit of $100,00 will become irrelevant at some point of this journey in the second and third examples. It doesn’t happen in the first example.

This thought would come up in your mind: If 4% monthly has tremendous capital accumulation power, why everyone isn’t rich. That is simple: because performance means risk. When you increase your performance, you increase your risk. This a mathematical law that we cannot escape from.

Conclusion

- You can become rich with little money;

- You need time to become rich. There is no miracle;

- You do need good investments. Diversify them is good practice; and

- If you have a risky investment, you do need to withdraw your money from it frequently.

How do I invest my money?

Probably you know this answer. In order to have performance rates that really will change your life, you need to risk your money somehow. Since you will risk little amount of your money, you can accept the risk. The place you will find those rates is in the financial market. You can learn how to that, and you can ask for advice. In this case, I would recommend you to look at this short article.